Frequently Asked Questions (and straight answers)

About VIXEK™

I hear "timing the market" is a fool's game. Why should I be interested in VIXEK™?

In our humble opinion, there's a difference between "timing the market" and "active management" of investments. We agree, determining the absolute top or bottom of the market is more a matter of luck than insight. VIXEK™, for sure, does not purport to be a market timing tool. It works to inform an active manager of investments what the "big whales" might be doing and how it might influence the market in the near term.

How is VIXEK™ calculated?

For obvious reasons, we cannot reveal the actual formula. The inputs to the formula include one-minute interval intra-day SPX data, VIX, number of advancers and decliners etc. It is calculated at the end of each trading day.

Why is VIXEK™ based on SPX (S&P 500) and not on any other index?

S&P 500 is widely considered to be the best representative of the broader US equities market. Hence, as a start, we have focused on SPX. We are in the process of considering other indices including overseas markets and commodities traded globally.

If VIXEK™ is calculated using one-minute, intra-day data, why is it not available until the end of the day?

While intra-day data is a critical part of the calculation, it is not sufficient to determine VIXEK™. Thus, we have to wait until all intra-day and end-of-day data is available..

I know you have created and tested VIXEK™ using 13 years worth of data. Why didn't you go back in time, say, another 10 to 20 years to at least include the 1987 crash?

Good question! As you probably know, market dynamics have changed significantly over the last 20 years. What moved the market then is probably not very influential now, and what moves the market now didn't matter or didn't exist back then. Thus, we believe that trying to connect too many dots too far apart would be misleading. Therefore, in developing our model we have purposefully avoided going too far back in time.

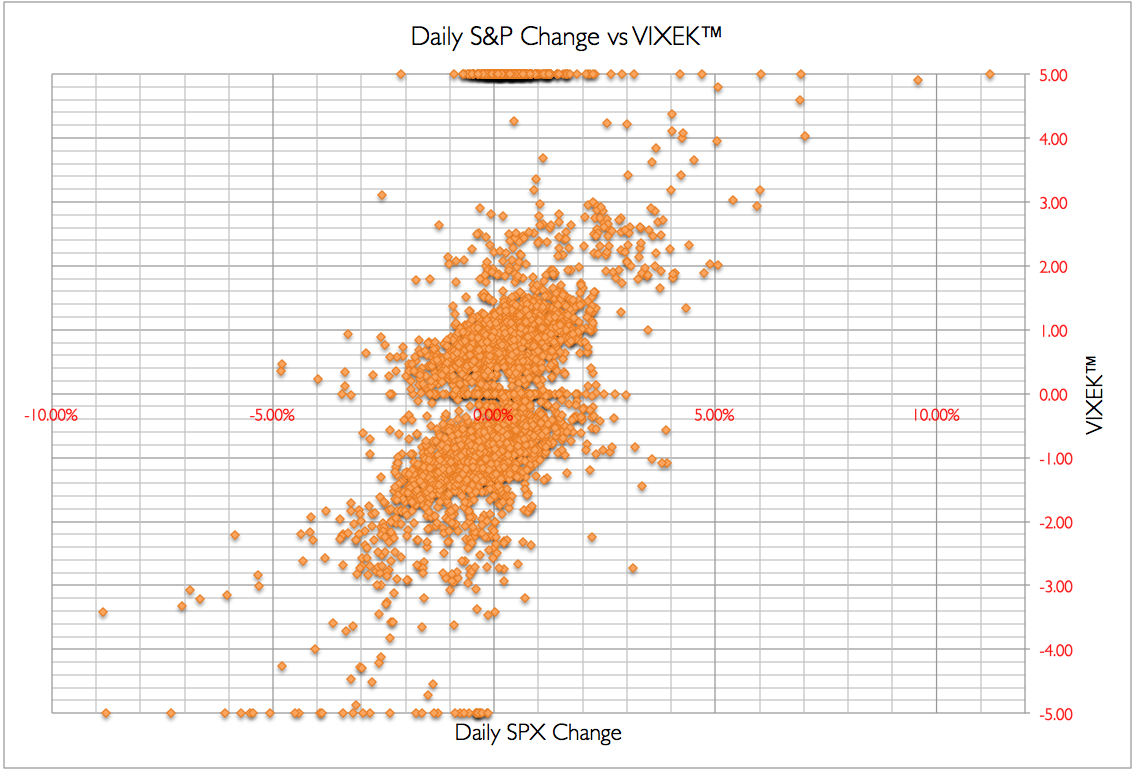

How does VIXEK™ correlate with daily change in S&P 500 index?

Coefficent of determination (R-squared) of VIXEK™ and daily change in S&P 500 is 0.23. In other words, about 23% of VIXEK™ value can be attributed to the change in the S&P 500 index.

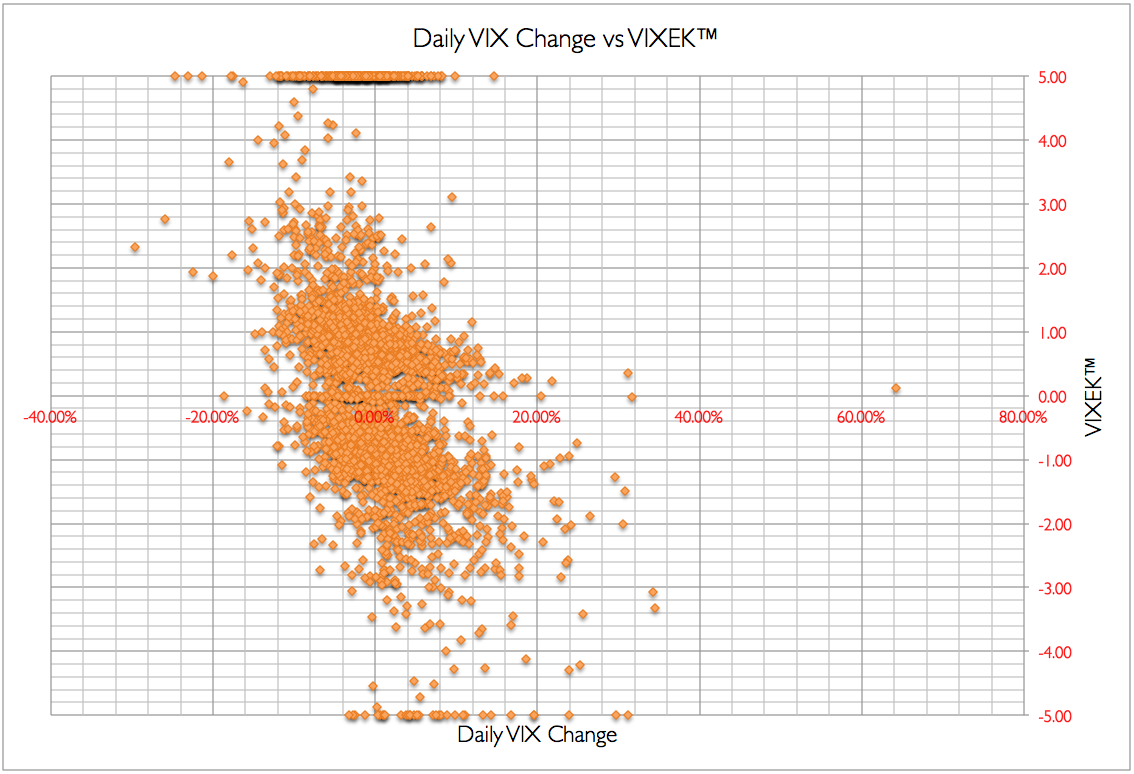

How does VIXEK™ correlate with daily change in VIX index?

Coefficent of determination (R-squared) of VIXEK™ and daily change in VIX index is 0.17. In other words, about 17% of VIXEK™ value can be attributed to the change in the VIX index.

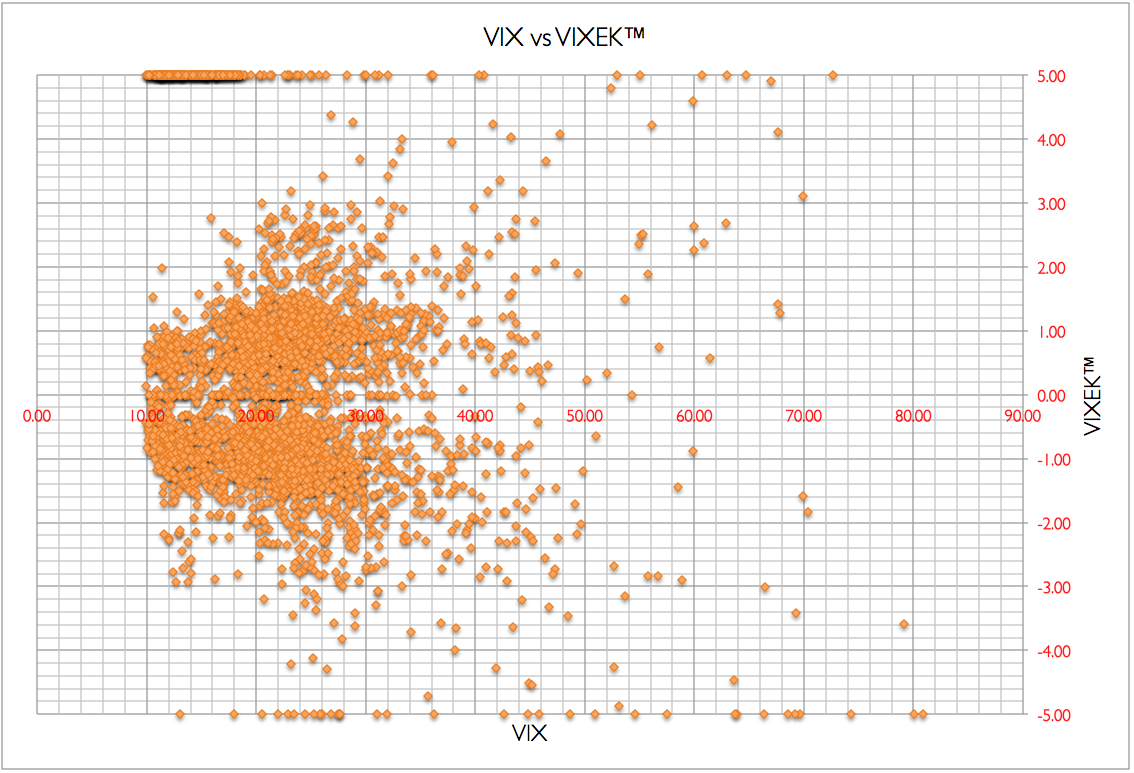

How does VIXEK™ correlate with VIX index?

Coefficent of determination (R-squared) of VIXEK™ and VIX index is 0.04. In other words, about 4% of VIXEK™ value can be attributed to the VIX index.

Do you think VIXEK™ might be the silver bullet or the holy grail of cracking open the stock market?

Most certainly not. Not that we don't like VIXEK™; because we do, and we use it ourselves everyday. But we fervently believe that there cannot be such a thing as a silver bullet or the holy grail of the stock market. Hence, we are certain that VIXEK™ is not that either.

How do you interpret and act when VIXEK™ gives a positive indication one day and turns negative a week later?

If you have been in the market for some time and have followed any of the talking heads or gurus, you will have noticed these pundits change their tunes faster than Lady Gaga's hair dos. As mentioned elsewhere in this site, VIXEK™ is intended to notice any big money movements made by market movers and since they tend to have schizophrenic movements, VIXEK™ tends to record and report the same.Bottom line: we follow the latest VIXEK™reading. It is the last reading that counts.

Is the latest VIXEK™ influenced by indicator readings of the previous few days?

We understand that some of the market's "emotional kinetics" can linger over for a few days. The formula for VIXEK™ takes into account previous few days readings and accordingly adjusts the latest indicator.

Would it be more meaningful to calculate VIXEK™ for individual stocks?

No. The underlying premise of VIXEK™ is that big investors' moves have an effect on the market and that these market movers, regardless of whether they are "bulls" or "bears" tend to move as a herd of wildebeests. Barring any stock-specific news, most of the large money managers tend to make their move across the board. Thus it is neither necessary nor useful to calculate stock specific VIXEK™. Needless to say, getting to know stock specific news is paramount; but that is not the intent of VIXEK™.

How did you come up with the name VIXEK™?

It may already be obvious to you that we did not hire a hot-shot marketing consultant. Since the fundamental premise of VIXEK™ is that market's "emotional kinetics" can overshadow almost anything else, we wanted to include that in the name. And since VIX, the S&P volatility index, also plays a role in its calculation, it took only one engineer to put the two together and come up with VIXEK™.

Application of VIXEK™

What is the time-frame in which VIXEK™ is applicable?

Through extensive research, we have found VIXEK™ is best at anticipating and indicating big (>5%) moves 4 to 6 weeks out. We have used this indicator as such and believe this to be the sweet spot for it.

Can it be used for day trading?

Yes and no. If one's day trading strategy is influenced by what might happen to the market in the next 4 to 6 weeks, VIXEK™ may be helpful. However, most day traders we know tend to have a shorter term focus and thus rely on other indicators. But hey, who are we to discourage wider application of VIXEK™.

Why have you presented the effect of VIXEK™ on two different types of funds (leveraged and unleveraged long-short funds)?

Power of VIXEK™ is in its ability to give fair warning about impending major moves in the market. This information can be used by most investors with a wide range of investments and investment styles. By applying VIXEK™ on both, a relatively conservative (unleveraged long-short) as well as a more aggressive (leveraged long-short) style of investing, we have tried to demonstrate its wide applicability and also show that it can be rewarding regardless of one's style of investing.

Can VIXEK™ be applied to a long-short fund that uses equities and not SPX-indexed ETFs?

Yes. If the right equities and options are selected, this could yield even higher returns by adding beta to the mix.